Fishon Amos

Fishon Amos

Making the case for adopting lightning as Africa’s unified payment standard

12/16/2025 • Fishon Amos

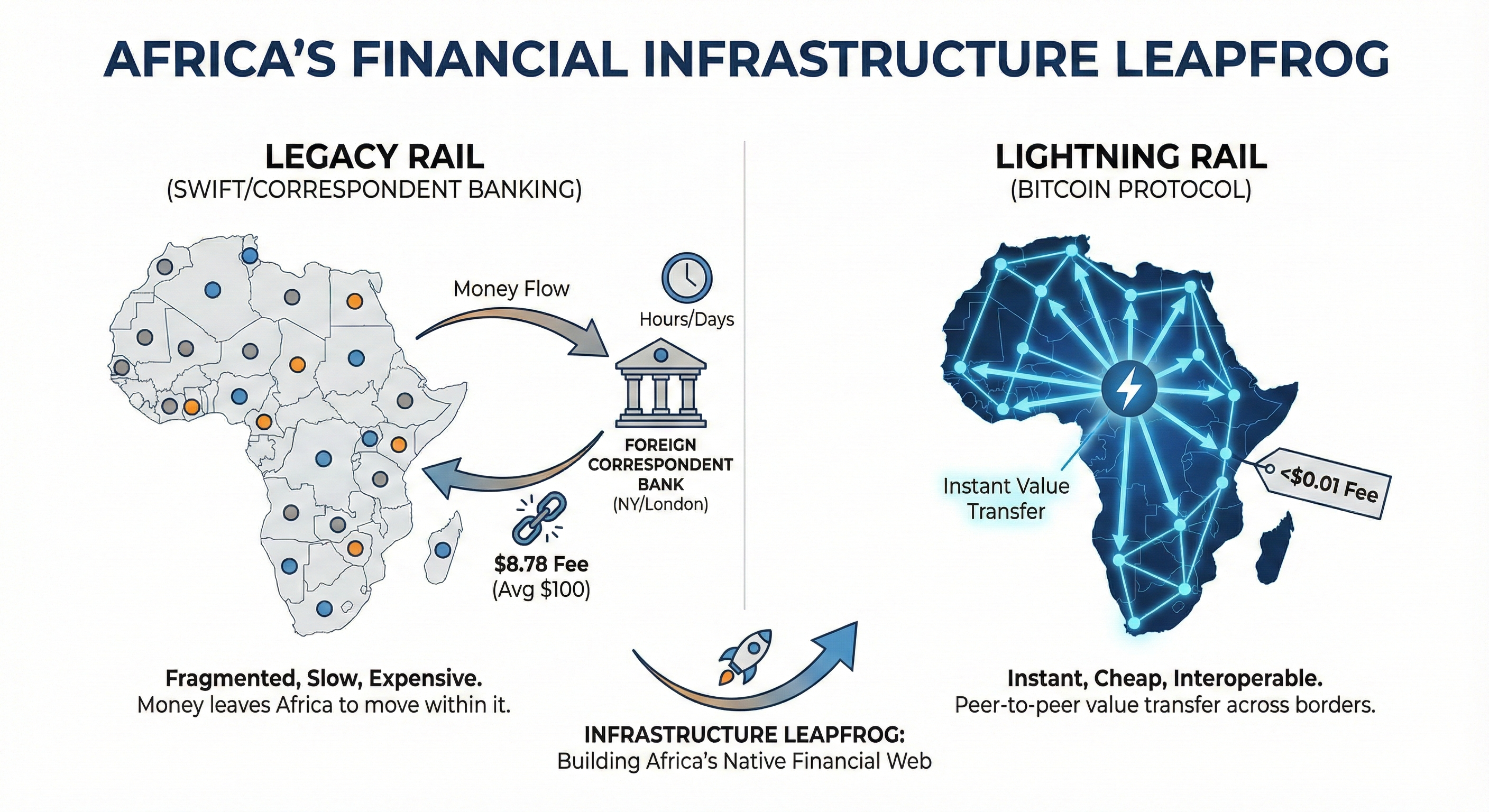

Just as Africa bypassed the landline era to build a mobile-first communication network, the continent will bypass the correspondent banking era to build a Bitcoin-native financial network. This is our own infrastructure upgrade.

The Connectivity

Sub-Saharan Africa is home to some of the most advanced fintech ecosystems in the world. Nigeria’s NIBSS, Kenya’s M-Pesa and Francophone Africa’s Orange Money are all technological marvels in their own right.

However, they suffer from a fatal flaw: They are islands.

An M-Pesa user in Nairobi cannot easily send money to a standard bank account in Lagos. To do so, the money must leave the continent, travel through a correspondent bank in New York or London, incur fees at every stop, and return hours or days later. This has effectively limited commerce between African countries.

Lightning as the TCP/IP of Money

The solution to this fragmentation is not another Super App trying to conquer 54 countries. The solution is an open standard.

The Bitcoin Lightning Network functions effectively as the TCP/IP (the open protocol of the internet) for money. It allows value to move instantly between any two points, regardless of the app the user is holding.

1. The Economic Case: Fees & Friction

The data makes an undeniable case for this transition.

- Legacy Rail (SWIFT/Remittance): A $100 cross-border payment incurs an average fee of ~$8.78.

- Lightning Rail: The same $100 payment can be settled for network fees of less than $0.01.

For a continent that processed $205 billion in on-chain value last year, the potential retained capital from switching rails is in the billions.

2. Unlocking the Micropayment Economy

Africa’s economy is powered by micro-commerce. Daily wages, small vendor purchases, and pay-as-you-go utilities often involve transactions under $5.00.

- The Problem: You cannot send $2.00 via Swift; the fees exceed the principal. The legacy system has a "minimum viable transaction" floor.

- The Solution: Lightning has no floor. It is economically viable to send $0.50 or even $0.05 across borders. This capability unlocks entirely new business models from streaming payments for content to real-time cross-border wage settlements that were previously impossible.

Addressing the Concerns

Critics often dismiss Bitcoin payments citing two barriers: Price Volatility and User Complexity. The market, however, has already engineered solutions to both.

- The Volatility: The chain analysis data shows that while Bitcoin is the preferred store of value (89% of purchases), Stablecoins are the medium of exchange (43% of volume). Modern apps (like Tapnob) use Lightning as the transport rail while settling in Fiat or Stablecoins. The user sends value instantly over the network but holds a stable asset. Lightning becomes the pipe and the dollar (or Naira) is the water.

- The Complexity: The "Internet" was once hard to use until browsers abstracted the complexity. Similarly, the next generation of African wallets has abstracted channels, liquidity management, and invoices. Users simply scan a QR code or type an address; the protocol handles the routing.

The Progress So Far

This aricle is not just a theoretical whitepaper. The physical and digital infrastructure is already being laid by a new generation of African companies into two interconnected layers:

1. The Infrastructure Layer: Companies like Bitnob and Mavapay are already doing the heavy lifting of connecting the Lightning Network to local banking rails.

2. The Experience Layer: If the infrastructure layer is about connectivity, this layer is about invisibility. The goal of companies here is to make the technology disappear so the user just sees money.

Tapnob is in this shift for the pan-African user. We have built a platform where users can move seamlessly from Fiat to Sats and stable assets, or pay any merchant directly in Sats. Whether it is moving from fiat or executing a split-second payment at a coffee shop, Tapnob provides the complete utility loop.

Other players are also strengthening the ecosystem; Tando, for instance, is doing impressive work in simplifying payments for East African users.

Conclusion

The $205 billion volume growth in Sub-Saharan Africa is not a signal of speculation. It is a rational market voting for better infrastructure.

We are witnessing an Infrastructure Leapfrog event where Africa is not waiting for Western banks to lower their fees or speed up their settlement times. We are building on a parallel, interoperable rail that is faster, cheaper, and permissionless

"Stay tuned for the latest news "